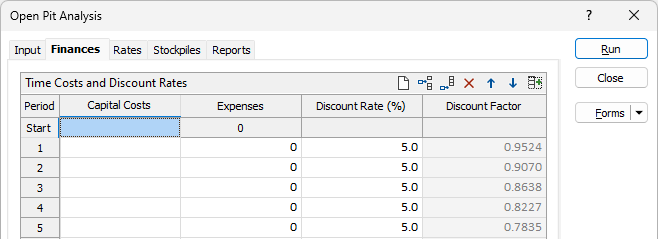

Finances

Use the Pit Optimisation > Analyse Pits > Finances tab to specify upfront capital costs, expenses that are incurred over the life of the mine and the rates at which cash flows should be discounted for the purpose of calculating the net present value.

The Finances tab is used only to specify settings for particular periods. It has no effect on the number of periods covered by the analysis, which is calculated to accommodate the mining, processing and selling rates specified on the Rates tab as required.

Time Costs and Discount Rates

Specify the following settings for each period as required:

Period

Start is the period leading up to the starting date for the analysis, for which only Capital Costs can be specified. Cash flows from this period are not discounted.

The periods are then numbered incrementally from the starting date of the analysis.

Capital Costs

(Optional.) Specify the value of any capital expenditure that is required to ensure that critical items of plant and equipment are in place prior to the commencement of mining.

For the purposes of determining the Net Present Value (NPV) and Internal Rate of Return (IRR) for the project, this expenditure will be deemed to have occurred in Period 0 (zero).

Expenses

(Optional.) Specify the value of any additional expenses that are incurred in the period.

This field is useful for specifying expenses that recur over multiple consecutive periods. Values entered are repeated for subsequent consecutive periods that have the same existing values assigned at the time of the entry.

If the analysis covers more periods than are specified on this tab, the value from the last period specified is used in all subsequent periods.

Discount Rate (%)

Specify the rate (% per period) at which the cash flows from the period should be discounted for the purpose of determining their present value.

The discount rate can be specified separately for each period.

If the analysis covers more periods than are specified on this tab, the rate from the last period specified is used for all subsequent periods.

Discount Factor

This reports the factor that will be applied to cash flows from the period when calculating their present value. It illustrates the compounding effect of the discount rates specified for the preceding periods.

Like the Expenses field, values entered are repeated for subsequent consecutive periods that have the same existing values assigned at the time of the entry.

Example: If a discount rate of 5% applies to each period, the discount factor reported for the 10th period will be 0.6139. This means that only 61.39% of the cash flows from that period will contribute towards the net present value. Increasing the discount rate to 10% results in only 38.55% of the cash flows from that period contributing towards the net present value.

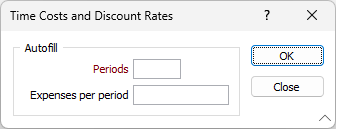

Pre-setting Values

Click the auto-fill button at the top right of the Time Costs and Discount Rates grid to set the number of periods for which expenses or discount rates are to be specified and the expenses incurred in each period.

The following dialog box will be displayed:

Periods

Specify the number of periods (excluding the Start period) for which capital costs, expenses or discount rates are to be specified.

Expenses per period

(Optional.) Specify the additional expenses that are incurred in each period.